Treasuries Are Best Described as the Federal Government's Debt Instruments

None of the above 3. The capital account balance includes all foreign private and government investment in the United States netted against US.

National Debt Hits New Milestone Topping 22 Trillion Http Back Ly Rvjyd Debt Milestone National Debt The Borrowers Pay Raise

By Wolf Richter Wolf Street.

. Government debt has been managed by the Bureau of the Fiscal Service succeeding the Bureau of the Public Debt. STIP VTIP and PBTP are the best Treasury ETFs for Q2 2022. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agenciesThe terms national deficit and national surplus usually refer to the federal.

A debt instrument or security with a high default risk and a low liquidity. Memorize flashcards and build a practice test to quiz yourself before your exam. Helps people in need.

Keeps the country out of debt. Treasury notes T-notes are the intermediate maturity 2C10 years government-issued debt instruments. Some of the most common.

He is an expert on company news market news political news. Treasury and backed by the US. The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders.

Below are the Schedules of Federal Debt and the accompanying notes as audited by the Government Accountability Office GAO going back to 1997. The model captures the dynamic interactions between economic conditions budget deficits. 1268824 All of the following are types of maturities for debt instruments except.

Treasurys operating cash is maintained in an account at the Federal Reserve Bank of New York and in Tax and Loan accounts at commercial banks. For companies seeking financing the higher the price of bonds the more attractive it is to sell bonds. Ashort-term debt obligation bissued by the US.

As bond prices rise people demand more bonds. Estimates suggest that the size of its balance sheetie the number of bonds it has boughtcould double or almost triple over the course of the year. Treasury bonds are a type of capital market instrument.

The bond supply curve slopes upward because. Matthew Johnston has more than 5 years writing content for Investopedia. Treasury bills notes and bonds.

The list below provides information on where there are differences in debt calculations related to the national debt. Who sets monetary policy in the United States. The datasets listed below only include debt issued by the Treasury Department.

Which definition best describes the process of zero-based budgeting ZBB. B Bonds are tendered for equity securities. Arbitrage is the simultaneous.

Federal Government cit is useful when imbalances exist between tax revenue and government expenditures dlong-term debt obligation. The national debt is best described as. T-bills are short term less than one year and T-bonds are long term 10 years or more.

Government Bond Funds and ETFs invest primarily in bonds and other debt instruments issued by federal state and local governmentsThe funds in this category may invest in bonds with short- intermediate- or long-term duration depending on the strategies of the respective funds. The Daily Treasury Statement DTS is available by 400 pm. Start studying the Finance Midterm flashcards containing study terms like True or False.

Question 84 of 106Question ID. Debt instruments bonds can be issued by corporations and both federal and municipal government entities. T-Bonds is the official term for a.

A Treasury Bill T-Bill is a short-term debt obligation issued by the US. During which of the following administrations did the US. Conversion is best described by.

TPDO is the sum of Debt Held by the Public and Intragovernmental Intragov Holdings. In addition the Federal Reserve is also buying new types of assets in new ways. In face of the incredibly spiking US gross national debt that just hit 30 trillion after having spiked by a mind-boggling 65 trillion since March 2020 the steamy-hot question is this.

Government with a maturity of less than one year. Treasury and backed by the US. The opinion statement issued by GAO is also included.

The question is particularly hot because Treasuries are now ugly instruments with the worst punishment yields ever. MSPD which contains detailed information on trust funds that own Treasury securities the Treasury International Capital TIC System which identifies foreign holders of US. Federal Reserve has said it could buy unlimited quantities of US.

None of the above 2. Who the heck is buying. D New bonds are sold and the proceeds used to redeem old bonds.

As bond prices rise people holding bonds are more tempted to hold them. Treasury bonds are long-term debt securities issued by the government with maturities greater than ten years. Which of these best describes the US.

Which of the following best describes a money market security. Government with a maturity of less than one year. This paper describes a model that can be used to inform debt management choices facing the US.

Investments in foreign countries True or False. United States Treasury securities also called Treasuries or Treasurys are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. As bond prices rise yields increase.

Only the Annual schedules are audited by GAO. Holders of United States Treasury securities were identified using three sources. A Treasury Bill T-Bill is a short-term debt obligation issued by the US.

A New bonds are exchanged for old bonds. 2019 and 2020. Anticipation notes are short-term municipal-issued revenue notes.

Some datasets include debt issued by the Federal Financing Bank FFB. Government Bond Government Bond Funds and ETFs invest primarily in bonds and other debt. Is responsible for monetary policymoney supply.

Federal debt and the System Open Market Account SOMA Holdings of Domestic Securities which reports Federal. C Bonds are paid off by a corporation prior to maturity. Federal government eliminate long-standing budget deficits and begin running budget surpluses.

Debt security instruments are complex advanced debt instruments structured for issuance to multiple investors. Debt instruments of state governments exempt from federal taxes certificates of loans or promises from a borrower to a lender to repay principal and interest accrued. It is a low-cost investment mechanism that enables businesses banks and the government to meet immense but short-term capital requirements at a reasonable cost.

Daily Treasury Statement DTS This statement summarizes the United States Treasurys cash and debt operations for the Federal Government. Schedules of Federal Debt - Annual Audited. Schedules of Federal Debt.

What Percent Of Returns Can The Debt Schemes Of Tata Amc Offer Debt Bond Funds Risk Free Investments

Anglo Saxon Central Banks Are Taking All The Risk Free Assets Asset Freak Out The Expanse

Foreign Holders Of Us Treasuries Foreign Big Picture Holder

Word Of Day Aaj Ka Gyan Stock Market Marketing Data Automated Trading

Government Securities Are Bonds Issued By A Government Government Securities Can Also Pay Interest U S Trea In 2021 Government Debt Government Bonds Corporate Bonds

Pin By Anthony Adams On Redemption A4v Redemption Accounting How To Fix Credit

Money Banking And Monetary Policy Cheat Sheet By Kali Winn98 Download Free From Cheatography Cheatograp Monetary Policy Economics Lessons Economics Notes

Aaj Ka Gyan One Month Effect Of Idbi Bank Stock Price Stock Price Idbi Bank Stock Market Stock Prices

Douglas Riddle Afv Accepted For Value How To Fix Credit Knowledge And Wisdom Financial Advice

Which Countries Own The Most U S Debt The Foreign Countries Holding The Most U S Debt In The International Finance S Foreign Countries Debt Borrow Money

3 120 Likes 26 Comments Vanessa Adagio Studies On Instagram More Notes And Funny Lighting Notes Inspiration Study Motivation Study Notes

During Your Lifetime You Have Probably Not Had The Secretary Of The Treasury Irs Paying Discharging Yo Budgeting Finances Common Law Insurance Benefits

Us National Debt 1940 2010 Power Of Data Visualization National Debt National Chicago Tribune

Aaj Ka Gyan One Month Effect Of Hcl Technologies Stock Price Stock Price Hcl Technologies Stock Market Technology

The Debt Ceiling Battle Explained In 12 Charts The Borrowers Borrow Money Infographic

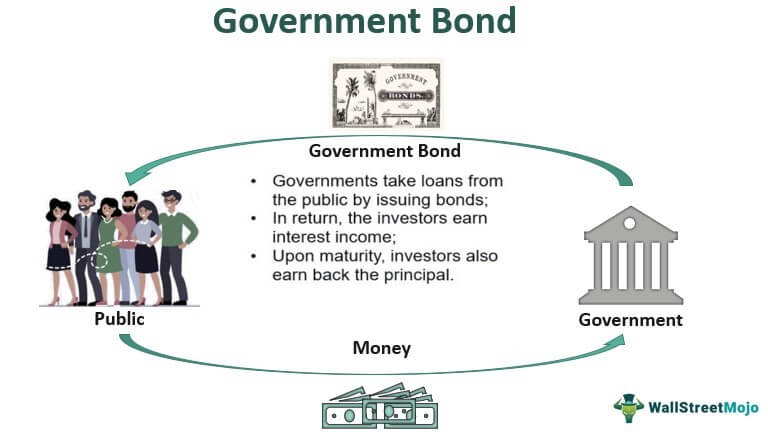

Government Bonds Definition Types Rates How To Buy

Tracy Alloway Tracyalloway Twitter Government Agency Mutuals Funds Regulatory

Comments

Post a Comment